Best Way To Invest In Gold

Self Directed Ira

You probably understand about the idea of inflation, in which the worth of the dollar continuously decreases gradually. For example, it costs a lot more to purchase a 1,000-square-foot home today than it did 50 years earlier. As an outcome, all the paper financial investments you hold need to increase in worth by a higher rate than the inflation rate to remain successful.

Gold prices change regularly due to supply and demand, the amount of gold in bank reserves, and investor behaviors. As an outcome, when the dollar's worth falls, the expense of gold often increases. Gold offers deflation security. Along with hedging versus inflation, gold can likewise secure your possessions against deflation.

Gold is a reasonably stable place to keep one's money, leading the buying power of gold to increase throughout the Great Anxiety and other considerable periods of deflation. Gold can diversify your investment portfolio. Have you ever heard the expression, "You should not keep all your eggs in one basket?" This saying applies considerably to the stock market (best gold ira companies 2022).

Best Gold Ira Companies For 2022 - Top Rated Precious

Nevertheless, diversifying your portfolio can assist you manage danger and minimize the volatility of your property prices. One easy way to diversify your financial investments is to purchase a gold IRA along with your conventional retirement properties. Understanding a gold individual retirement account rollover Most of the gold IRA companies on our list do not permit you to open a gold IRA from scratch.

This latter alternative is referred to as a gold individual retirement account rollover. Individual retirement account rollovers must conform to specific rules and policies from the internal revenue service. If you choose to roll over funds from an IRA, you can not hold those funds in your account for longer than 60 days prior to investing them into a new IRA.

/images/2021/08/06/gold-stocks-to-invest-in.jpg)

Rolling over an individual retirement account is a more involved procedure than transferring funds from one individual retirement account to another. best gold ira. Rollovers tend to be faster than transfers, taking place in 60 days or less in a lot of instances. The business on our list can help you help with gold individual retirement account rollovers to make the process as seamless as possible and make sure that you do not face any additional penalties due to misguidance.

Best Gold Etf 2022

/images/2021/08/06/gold-stocks-to-invest-in.jpg)

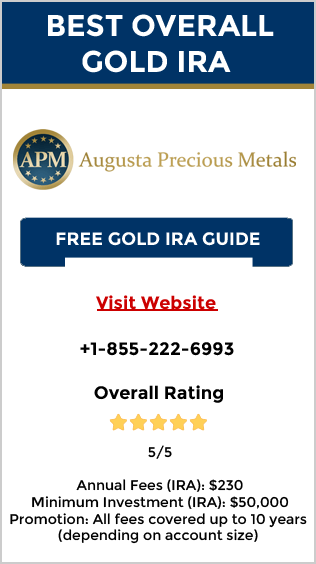

Numerous gold Individual retirement account business have their own minimum financial investment requirements that you need to meet to work with them. If your existing retirement accounts have actually not accumulated much worth since you opened them, you may desire to look for a gold Individual retirement account business with a low minimum investment requirement.

Unfortunately, when you invest in a gold IRA, you can not keep the physical gold bullion at house. Instead, the internal revenue service requires gold IRA investors to keep their gold with an IRS-approved custodian, such as a bank, cooperative credit union, or other banks. If you select to overlook this rule and keep your gold in the house, your gold will qualify as a distribution, indicating that you might deal with a 10% tax penalty.

Even even worse, keeping your gold investment in your home might lead to a tax audit, which might demand additional charges from the IRS. If you 'd choose to own gold and store it wherever you want, you may wish to buy gold bullion straight from one of the gold IRA providers on our list.

Invest In Gold - Best 3 Usa Gold Ira Companies

When you receive this gold, you can keep it in the house, shop it with a custodian, or do whatever you desire with it. Which IRS-approved coins can you keep in a gold IRA? As we pointed out earlier, the metals you buy for an IRA investment need to meet particular internal revenue service requirements for quality and pureness (best gold investment companies).

The IRS acknowledges particular gold bullion and other valuable metal coins as satisfying these requirements. The IRS accepts the following gold coins for gold IRAs: American Gold Eagle bullion and proof coins American Gold Buffalo uncirculated coins Chinese Gold Panda coins Australian Kangaroo/Nugget coins Canadian Gold Maple Leaf coins Austrian Gold Philharmonic coins When you work with a credible gold IRA supplier, you can feel positive that the gold you purchase will meet IRS requirements.

Initially, many individual retirement account companies charge a preliminary account setup cost that covers the work included in creating your financial investment account. This cost normally varies from $50 to $150. Some companies waive this cost for larger investment deposits. Next, numerous IRA business charge a yearly administrative charge that covers the expense of keeping your account open every year.

Gold Stocks

What is the best time to buy gold in 2021?

Since 1975, the gold price has tended to drop the most in March. The daily chart above shows April might offer a slightly lower overall price, but history shows March is the month gold falls the most and is thus one of the best times to buy.

What will gold price be in 10 years?

The World Bank predicts the price of gold to decrease to $1,740/oz in 2021 from an average of $1,775/oz in 2020. In the next 10 years, the gold price is expected to decrease to $1,400/oz by 2030.

What will be the gold rate in 2022?

Gold rates today, 25 March 2022: Gold rates in Delhi per 10 grams of 22 carats is at Rs. 47,340 and the rate of 10 grams of 24 carats is at Rs. 51,660.

Will gold ever lose its value?

Although the price of gold can be volatile in the short term, it has always maintained its value over the long term. Through the years, it has served as a hedge against inflation and the erosion of major currencies, and thus is an investment well worth considering.

You'll need to pay a storage cost to the depository that holds your financial investment. Some custodians charge a flat annual charge, while others base their storage fees on the quantity of gold in the account. On top of these standard costs, individual retirement account service providers can pick whether to charge a commission for purchasing gold for their customers.

However, numerous financiers find that the advantages of gold investing make these higher charges worth the cost. Where are the rare-earth elements inside your gold individual retirement account kept? When you open a gold IRA account, you will require to keep your investment with a custodian, such as a bank. Nevertheless, you can choose which custodian will hold your gold for you.

Nevertheless, you can select to deal with these custodians or various ones. Either way, we suggest asking a depository for its licenses and registrations prior to you trust it with your gold investment. Stopping working to perform these background checks may position you at risk of losing your investment totally. Last ideas Buying a gold individual retirement account is an exceptional method to diversify your retirement portfolio and decrease the volatility of your properties.

Why Invest In A Gold Ira? Crash Proof

If you're still uncertain which IRA supplier is the very best gold individual retirement account business for your needs, we advise asking for the complimentary brochure from each supplier and comparing the benefits and drawbacks of each organization. Nevertheless, because all of these business use comparable services, you can't go incorrect choosing any of them to facilitate your gold individual retirement account investment.

Check out the companies on our list today to begin the procedure of rolling over funds from an existing retirement account to a more stable gold individual retirement account - Goldco. * This article is provided by an advertiser and not always composed by a monetary consultant. Investors must do their own research on services and products and call a financial advisor before opening accounts or moving money.

check that website here additional hints top gold ira companies